I. Crypto Assets and the Tax Agency: New Oversight of Your Investments

In an increasingly digital financial world, crypto assets have gained growing importance among both investors and speculators. It’s no longer uncommon for small investors to have savings in cryptocurrencies or to have carried out several buy-sell transactions. Cryptocurrencies are no longer seen as something risky, but rather as another intangible asset, comparable to stocks or investment funds.

Moreover, the exponential gains in recent years have caught the attention of the Spanish Tax Agency (Hacienda), which discovered that many taxpayers were not reporting capital gains derived from these assets. To improve control over the ownership and movements of crypto assets, the Tax Agency has imposed a requirement on crypto service providers operating in Spain to notify the Spanish authorities of wallet balances as of December 31st (Form 172) and all transactions made throughout the year (Form 173).

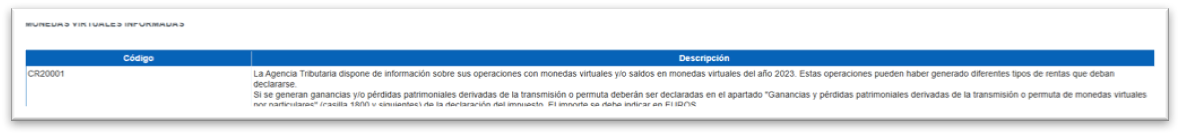

The first year this requirement came into effect was 2023. Providers like Binance, Coinbase, Bit2Me, among others, were required to submit Forms 172 and 173 in January 2024. As a result of these submissions, many taxpayers received a message in their tax data such as this:

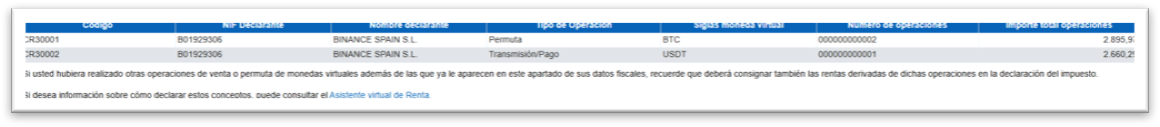

This year, the situation has progressed further. Instead of just a generic warning, your tax data may now already include specific details of the transactions made during the year, which makes it clear that the Tax Agency is taking tighter control over crypto operations:

Today more than ever, it is essential to understand the tax impact of holding crypto assets and how the gains or losses from their transfer must be correctly reported.

II. How are crypto assets reported in the income tax return?

In the income tax return, crypto assets are reported as capital gains or losses. If there has been a transfer of crypto assets (buy-sell, crypto-to-crypto exchange, or using crypto for payment, among others), the gain or loss is calculated as the difference between the purchase price and the sale price. This gain or loss is included in the savings tax base and is taxed according to the following progressive rates:

- 19% for gains up to €6,000

- 21% for gains from €6,000.01 to €50,000

- 23% for gains from €50,000.01 to €200,000

- 27% for gains from €200,000.01 to €300,000

- 28% for gains over €300,000.01

It’s important to note that losses can also be offset against other capital gains, which can reduce the taxable base and therefore the tax burden.

III. How are crypto assets reported in the Wealth Tax return?

In the Wealth Tax return, crypto assets must be included as part of an individual’s wealth, as they are considered goods or rights with measurable economic value. Like other assets, crypto assets must be valued based on their market price as of December 31st of the relevant year. In this case, the value of the cryptocurrencies or tokens must be based on the exchange rate on that date.

For example, Bitcoin on December 31st, 2024, closed at a value of $93,557.2 (according to Investing.com and Yahoo Finance), which would be approximately €85,857.44 (using an exchange rate of 0.9177). In your tax data, the value of the crypto assets will be shown in euros as of December 31st. However, if the Bitcoin was stored in a cold wallet, the corresponding exchange rate would still be used for the declaration.

At LGConsulting, we’re here to help you navigate the complex tax processes related to crypto assets. We know how important it is to meet your tax obligations correctly and efficiently, especially with the new regulations affecting the income tax return and the Wealth Tax. Our tax experts have deep knowledge of the digital sector and are prepared to offer personalized advice that optimizes your tax situation and helps you avoid issues with the Tax Agency.

If you have crypto assets and are unsure how to declare them, or if you need help understanding the tax implications in your return, don’t hesitate to contact us.